In supply-side economics, the dollar - or any currency - is seen as a commodity, one that goes up and down in value with supply and demand. If you have an excess supply of dollars, dollars become plentiful relative to goods, and the dollar price of goods will go up. Conversely, an excess demand for dollars leads to a scarcity of dollars relative to goods and a fall in dollar prices. Excess supply of dollars leads to inflation, excess demand, deflation.

During an inflation, commodity prices - especially gold and oil - are the first to go up, and we see a boom in the commodity-producing sectors (such as oil and mining) and real estate, and also in the financial sector. Investment banking, stock trading, private equity, lending, will experience good times; an excess supply of dollars leads to the phenomenon of 'hot money' - large amounts of dollars being passed from hand to hand and which must be spent, invested or lent.

Commodity prices will go up before consumer prices in an inflation, and the gold price will go up before other commodity prices. The gold price, out of the entire 'galaxy of prices' (as Jude Wanniski calls it) is the first to tell us how much 'liquid' - how many dollars - is out there. If the gold / dollar price stays stable, then the central bank is providing just the right amount of liquidity. Under a gold standard, the central bank keeps the dollar fixed to gold - that is, keeps the gold / dollar price stable.

In August 1971, Nixon took America - and the world - off the gold standard. We saw skyrocketing gold prices. The green bar measures the rapid rise of the gold / USD price, which peaked at around $USD850/oz in day trading (the grey-shaded columns indicates recessions):

That led to, as we could expect, high inflation - the worst global inflation in history. But monetary policy can turn the other way. Excess demand for the dollar can cause a sharp drop in the gold / dollar price. Here the red bar measures gold / USD price's fall, from one of the most severe deflationary episodes in US history - the early 1980s under Reagan:

Commodity and real estate prices collapsed, and commodity producers were wiped out. The financial sector, which had been lending cheap money to the Third World during the 1970s, also experienced a downturn. Because of the scarcity of liquid, short-term money market interest rates went into the double digits.

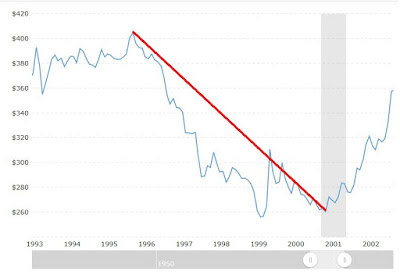

The second episode occurred in the late 1990s, in Bill Clinton's second term:

Again, commodity producers were hit hard - the oil price sank to $USD10 a barrel - and investors pulled money out of commodity producer stocks and shovelled it into risky dot-com companies.

The Bush 43 years - the 2000s - saw a remarkable rise in gold and commodity prices, with gold hitting (what was then) an all time high of around $USD1000 / oz. in trading. Then, in that fatal summer of 2008, the gold price fell - and fell - and fell. It dropped to nearly $USD700/oz.

As in the early 1980s, the financial sector was hard-hit.

Bernanke piled more liquidity into the financial system after 2008, and gold went up and up, peaking at nearly $USD1900/oz. in 2011. After 2012, Bernanke backed off on the quantitative easing experiment - which had not produced much in the way of growth - and the gold price has been trending downwards ever since, a descent which has only accelerated since Bernanke's departure. Gold has bottomed at around $USD1000/oz. a year ago - in November 2015 - and after a brief turn upwards, seems to be going downward again. The present close is $USD1181/oz. It should go lower over the coming months.

The gold price drops because of an excess demand for dollars - what causes that excess demand? In the early 1980s, Reagan cut the top rate of personal income tax from 70% to 50% and capital gains from 28% to 20%. This led to a huge demand for dollars. In the late 1990s, Bill Clinton's tax cuts on capital gains (back to 20%, where it had been at Reagan's first term) and on Roth-IRAs brought about that excess demand. Now, in 2016, investors are driving up the value of the dollar in anticipation of deregulation and huge - yuge! - tax cuts under Trump. The prospect of the Fed's raising interest rates this December also plays a part.

During a deflation, consumers - and consumer goods industries - benefit from the rising dollar; but, because there are not enough dollars to pay for all the goods being produced, a recession results more often than not. That was the case in 1981-82, 2001 and 2008-09. Hopefully, that won't come about this time.

At the moment, the markets seem to be taking the deflationary wobble in its stride. If we are to divide the Dow Jones by an ounce of gold, we see that the Dow hit its highest in the Obama years in November 2015, when it reached 16.69 ounces (not coincidentally, gold reached its lowest level in years - around $USD1000/oz. - in that same month). Since November 2015, the Dow has fallen in value. But after Trump's election, it is making up its losses.

It could go higher. During Bush 43's first term, the Dow hovered around 25 oz. The Trump recovery could see the Dow returning to that level. The future looks bright.

No comments:

Post a Comment